Exiting a business can be a complex and emotional decision for any business owner. Whether they’ve spent years building their enterprise from the ground up or have overseen its growth and success, the prospect of letting go can be daunting.

However, despite the potential benefits that come with exiting a business at the right time, there are several reasons why business owners might choose to delay this crucial step.

This blog will delve into these reasons and provide counterarguments to help business owners overcome their hesitation.

Emotional Attachment:

Reason: Business owners often have an emotional connection to their company, seeing it as an extension of themselves. The thought of parting with something they’ve poured their heart and soul into can lead to a reluctance to exit.

Counterargument: While the emotional bond is understandable, it’s essential to consider that over-attachment might cloud judgment. Objectively evaluating the business’s current state and prospects can help owners make a more informed decision. Remember that the legacy of the business can live on, and exiting might offer new opportunities for growth and personal development.

Financial Concerns:

Reason: Uncertainty about post-exit financial stability can lead business owners to delay their exit. If the business isn’t performing well, they might worry about the financial implications of exiting during a downturn.

Counterargument: Delaying the exit might not necessarily improve the financial situation. A thorough assessment of the business’s financial health and seeking professional financial advice can provide a clearer picture. Additionally, exiting the business could release resources that can be invested in more promising ventures or provide a comfortable retirement if managed wisely.

Market Conditions:

Reason: External factors, such as economic volatility or unfavourable industry trends, might make business owners hesitant to exit when market conditions are uncertain.

Counterargument: Waiting for perfect market conditions can be a never-ending endeavour. Instead, adapting the business to changing circumstances or finding creative ways to navigate challenges could position the business for success regardless of market fluctuations. An agile and strategic approach could yield better results than waiting for an ideal scenario that might never come.

Succession Planning:

Reason: The absence of a suitable successor can lead business owners to delay their exit, fearing that the transition might disrupt the company’s operations.

Counterargument: While succession planning is crucial, it’s also important to realise that developing potential successors takes time. By investing in training and mentorship, business owners can prepare a strong leadership team capable of guiding the company effectively. Moreover, having a successor ready should allow an owner to continue if other aspects of the business are in order.

Fear of Regret:

Reason: The fear of regretting the decision to exit, especially if the business holds sentimental value, can paralyse business owners into delaying their exit.

Counterargument: Regret can stem from not exploring new opportunities or staying in a comfort zone. Recognise that growth often comes from stepping out of familiar territory. Assessing the potential benefits of an exit, both personally and professionally, can help mitigate the fear of regret.

Lack of Retirement Plans:

Reason: Inadequate retirement planning might lead business owners to delay their exit until they feel financially secure enough to retire comfortably.

Counterargument: Delaying the exit solely for retirement planning can be counterproductive. Business owners can create a comprehensive plan that ensures financial security by working with financial advisors and exploring retirement options. Exiting the business might free up resources for retirement funds or open doors to new income streams.

Unrealistic Valuation Expectations:

Reason: Business owners might delay exiting if their valuation expectations don’t align with market reality, fearing they won’t receive fair compensation for their efforts.

Counterargument: Valuation is a negotiation process that requires flexibility. Consider obtaining professional valuation services and exploring ways to increase the business’s value before exiting. Holding onto an unrealistic valuation might lead to missed opportunities or prolong the exit process unnecessarily.

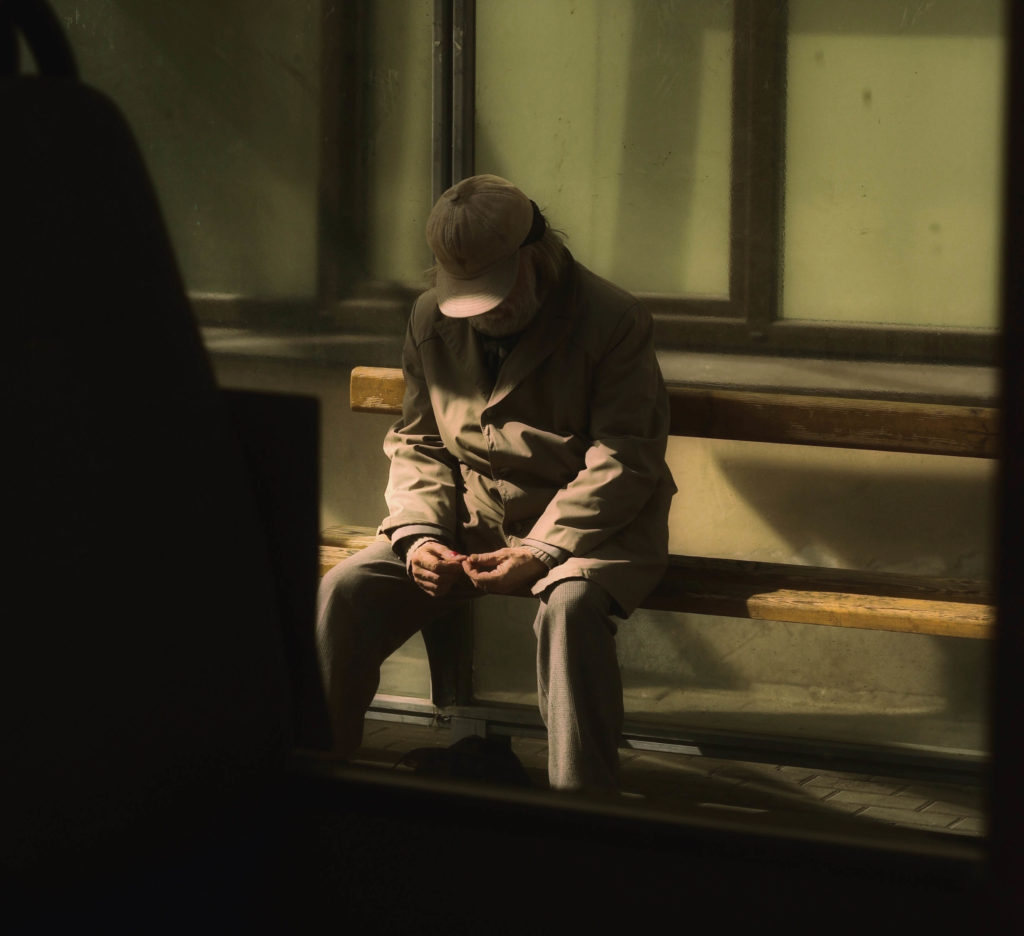

Loss of Purpose:

Reason: Exiting a business can create a void in the owner’s life, leading to a delay as they struggle to find new sources of purpose and fulfillment.

Counterargument: While the business might have been a significant source of purpose, exiting could also open doors to new passions and ventures. Engaging in hobbies, philanthropy, or mentoring can provide a sense of purpose beyond the business realm.

Complexity of Exit Process:

Reason: The intricacies of selling or transitioning a business can be overwhelming, causing business owners to delay their exit to avoid dealing with the complexities.

Counterargument: The exit process can indeed be complex, but seeking professional guidance, such as legal and financial advisors, can streamline the process. Delaying the exit might only prolong the challenges while missing potential opportunities for a smoother transition.

Desire for Growth:

Reason: A business owner’s desire to continue growing the company might lead to a delay in exiting, as they believe there are untapped opportunities for expansion.

Counterargument: Growth should always be pursued, but evaluating whether continued growth aligns with long-term goals and market trends is essential. Exiting at the right time might enable the owner to capitalise on the business’s current value and move on to new ventures.

Conclusion:

Exiting a business is a significant decision that requires careful consideration. While the reasons mentioned above might cause business owners to delay their exit, it’s important to assess each factor and weigh it against potential benefits critically.

Seeking professional advice, evaluating personal goals, and objectively analysing the business’s current state are all essential steps in making a well-informed decision about when and how to exit a business.